How To File Your LLC’s Certificate Of Formation With The State

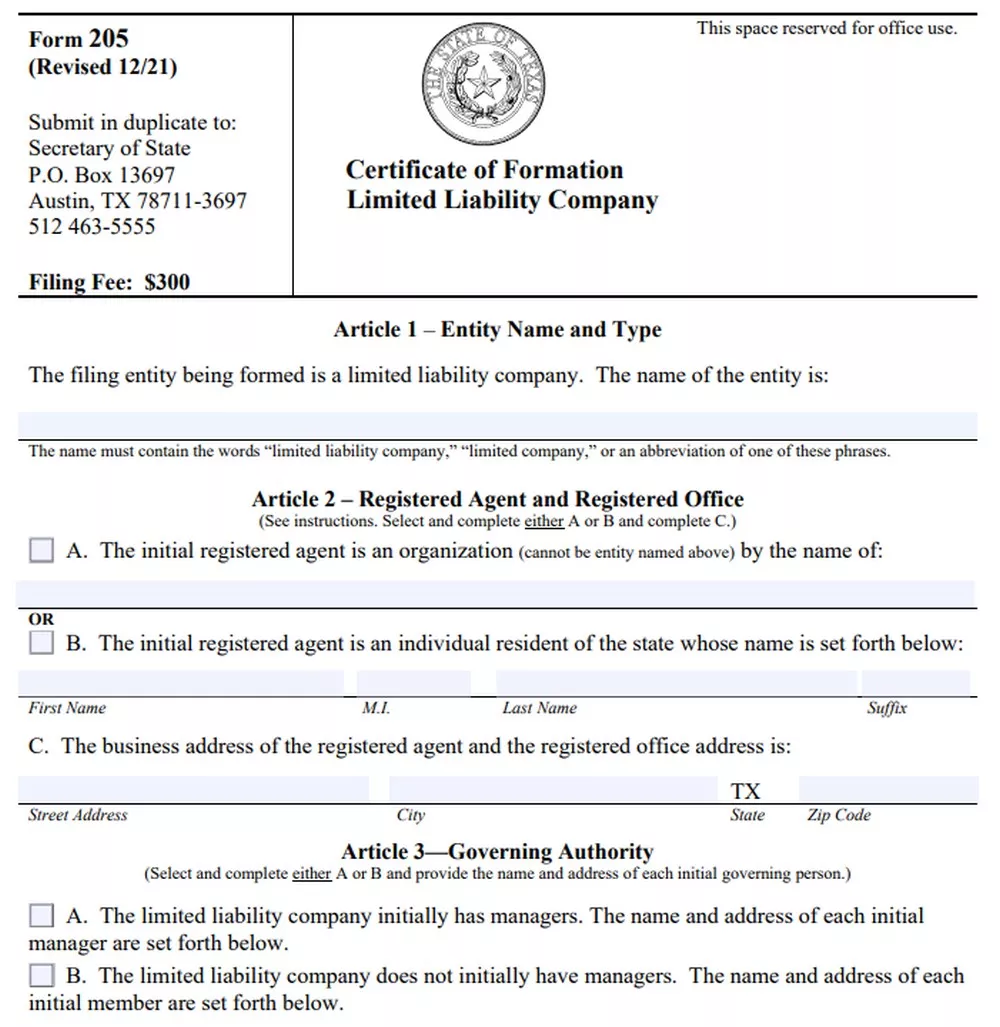

If you’re forming an LLC, you’ll need to file your certificate of formation with the state. This document is also sometimes called the articles of organization.

With extensive knowledge and experience in various financial products, OnlineLoansFlorida offers advice to you in managing personal finance. Get the basic advantages of budgeting such as it gives you control over your money, keeps you focused on your money goals, makes you aware what is happening with your money, enables you to save for expected and unexpected costs as well as allow you to produce extra money.

The certificate of formation is a simple document that includes the LLC’s name, address, and the names of the LLC’s organizers. You’ll also need to include the LLC’s purpose, which is usually just to engage in any lawful business activity.

Once you’ve completed the certificate of formation, you’ll need to file it with the secretary of state’s office in the state where you’re forming your LLC. The filing fee is usually around $100.

After you’ve filed the certificate of formation, you’ll need to draft and adopt LLC operating agreement. This document sets forth the LLC’s rules and regulations, as well as the rights and responsibilities of the LLC’s members.

Once you’ve formed your LLC and adopted an operating agreement, you’ll be ready to start doing business!

If you’re forming a limited liability company (LLC), you’ll need to file your LLC’s certificate of formation with the state. This document is also sometimes called the LLC’s articles of organization.

The certificate of formation is a simple document that includes your LLC’s name, address, and the names of its members. You’ll also need to include the LLC’s purpose and the name and address of your LLC’s registered agent.

Your LLC’s registered agent is the person or business that will receive legal documents on behalf of your LLC. This person must be available during normal business hours to accept service of process (SOP).

You can usually file your LLC’s certificate of formation online, by mail, or in person. The filing fee is typically around $100, but it may be more or less depending on your state.

Once you’ve filed your LLC’s certificate of formation, you’ll need to draft and sign an operating agreement. This document outlines the LLC’s ownership structure and how it will be governed.

After you’ve filed your certificate of formation and signed your operating agreement, you can start doing business as your LLC.