The Disadvantages Of Having A 547 Credit Score Car Loan

It’s no secret that a lower credit score can lead to a higher interest rate on your car loan. But what you may not know is that a 547 credit score can put you in a very precarious financial position. Here are a few things to consider if your credit score is in the 547 range:

You May Not Qualify for the Best Interest Rates

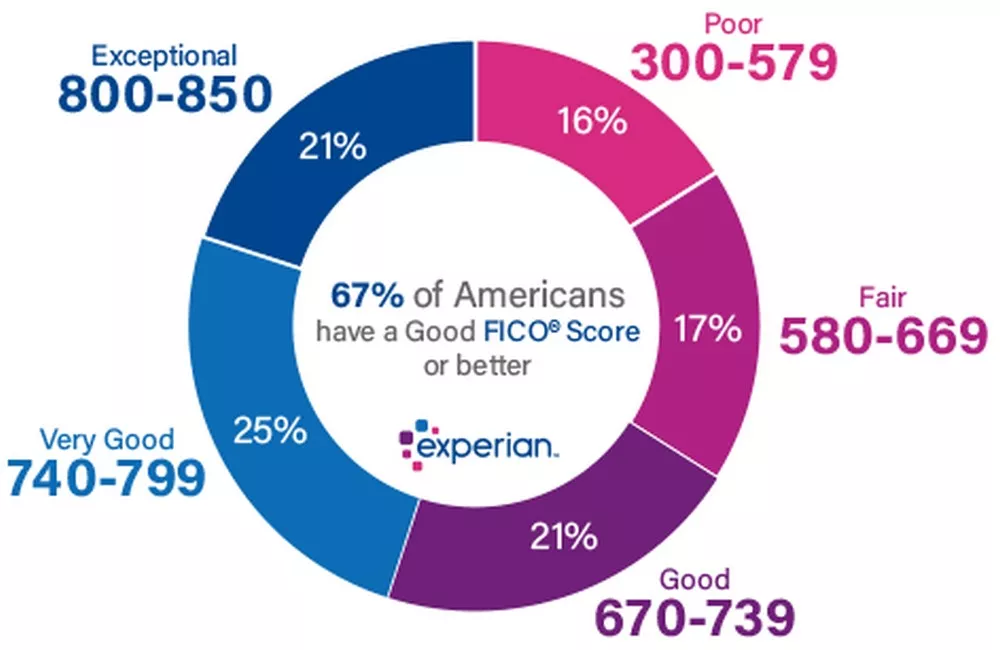

If you’re looking for the best interest rates on your car loan, you may be out of luck with a 547 credit score. Most lenders consider anything below a 580 to be subprime, which means you’ll likely be stuck with a higher interest rate.

The best way to find the right information for you is to do the

research, talk to professionals and weigh your options. Armed with the

right information, you can make a better-informed decision

that puts your needs, and budget, first. OnlineLoansFlorida.com is a experienced personal finance blog. They writing blogs and

articles on money, debt and loans since 2010.

You May Not Qualify for the Loan at All

In addition to higher interest rates, a lower credit score can also mean you won’t qualify for the loan at all. Lenders are often hesitant to give loans to people with lower credit scores, so if your score is in the 547 range, you may not be able to get the loan you need.

You May Have to Put Down a Larger Down Payment

Another downside of having a lower credit score is that you may have to put down a larger down payment. Lenders often require borrowers with lower credit scores to put down a larger down payment as a way to offset the risk of the loan.

You May Have to Pay a Higher Interest Rate

As we mentioned before, one of the biggest disadvantages of having a lower credit score is that you’ll likely have to pay a higher interest rate on your loan. This can add hundreds or even thousands of dollars to the total cost of your loan.

You May Have to Get a Co-Signer

If your credit score is in the 547 range, you may have to get a co-signer for your loan. This means that someone else will be responsible for making the payments on your loan if you can’t.

You May Have to Choose a Lesser Car

Because of all of the disadvantages of having a lower credit score, you may have to choose a less expensive car than you originally wanted. This can be a tough pill to swallow, but it’s important to remember that you can always trade up to a nicer car once your credit score improves.

If your credit score is in the 547 range, there are a few things you should keep in mind. Higher interest rates, larger down payments, and the need for a co-signer are all possible. But, by following some simple tips, you can improve your credit score and get the loan you need.