How Health Insurance Works: A Beginner’s Guide

When it comes to health insurance, there are a lot of moving parts. It can be difficult to understand how it all works together to help you stay healthy and financially secure. In this guide, we’ll break down the basics of health insurance so you can feel confident when making decisions about your coverage.

You can also use the third party website to stay up-to-date about business, small business, Insurance, Retirement, Real Estate or personal finance like Risethestudio.

What is health insurance?

Health insurance is a type of insurance that helps pay for medical expenses. It can help you pay for things like doctor visits, prescription drugs, hospital stays, and more. Health insurance can also help you protect your finances if you have a serious medical condition.

There are different types of health insurance, but the most common are private health insurance and public health insurance. Private health insurance is coverage that you get through an employer or that you buy yourself. Public health insurance is coverage that you get through the government, such as Medicare or Medicaid.

What does health insurance cover?

The type of coverage you have will affect what your health insurance plan pays for. Some plans may cover more than others. For example, a basic health insurance plan may only cover doctor visits and prescription drugs. A more comprehensive plan may also cover things like hospital stays, mental health, and maternity care.

Most health insurance plans have what’s called a deductible. This is the amount of money you have to pay for medical expenses before your insurance company starts to pay. For example, if your deductible is $1,000, you’ll have to pay the first $1,000 of your medical expenses yourself. After you’ve met your deductible, your insurance company will start to pay for some or all of your remaining medical expenses.

How much does health insurance cost?

The cost of health insurance depends on a few things, including the type of coverage you have and who you get your coverage from. If you have a private health insurance plan, your employer may help pay for some or all of your premiums. If you buy your own health insurance, you’ll have to pay the entire premium yourself.

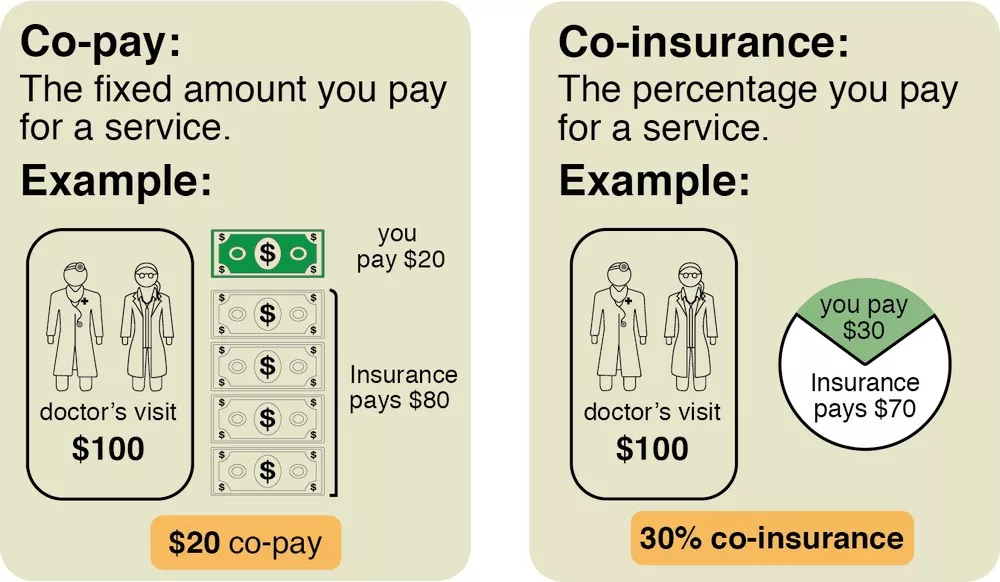

The amount you pay for your premium each month is just one part of the cost of health insurance. You’ll also have to pay for things like deductibles, copayments, and coinsurance. These are all out-of-pocket costs that you’ll have to pay even if you have insurance.

What are the different types of health insurance plans?

There are four main types of health insurance plans:

– Health Maintenance Organizations (HMOs)

– Preferred Provider Organizations (PPOs)

– Point-of-Service (POS) plans

– High-Deductible Health Plans (HDHPs)

Each type of plan has different rules about how you can use your coverage. For example, HMOs usually require you to see doctors who are in their network. PPOs usually let you see out-of-network doctors, but you’ll pay more for it. POS plans are a combination of HMOs and PPOs. HDHPs have high deductibles, but they usually have lower premiums.

How do I choose a health insurance plan?

There are a few things you should consider when choosing a health insurance plan:

– What type of coverage do I need?

– What can I afford to pay in premiums and out-of-pocket costs?

– Do I need a plan that covers me in all 50 states?

– Do I need a plan that covers me if I travel outside of the country?

The best way to find a health insurance plan that meets your needs is to use the Health Insurance Marketplace. The Marketplace is a website where you can compare different health insurance plans and find the one that’s right for you.

You can also talk to a licensed insurance agent or broker. They can help you understand your options and choose a plan that meets your needs.

When can I enroll in a health insurance plan?

There are two main times when you can enroll in a health insurance plan:

– During the open enrollment period

– If you have a qualifying life event

The open enrollment period is the time of year when you can sign up for health insurance. For 2020, the open enrollment period is from November 1, 2019 to December 15, 2019.