5 Things To Know Before You Refinance Your Student Loans At A Credit Union

If you’re considering refinancing your student loans, you may be wondering if a credit union is the right option for you. Here are five things to keep in mind before you make a decision.

Credit unions generally have lower interest rates than other lenders.

If you’re looking to save money on your student loan payments, a credit union is a good place to start. Credit unions typically offer lower interest rates than banks or other lenders, which can help you save money over the life of your loan.

Find most popular financial education, credit union, debt guide and many more with C1styourvoiceblog.

Get tips and

information for business growth, executive careers, personal life and

performance. You will get on with making a better life for yourself.

You may need to be a member of the credit union to qualify for a loan.

In order to qualify for a student loan from a credit union, you typically need to be a member of the credit union. This means you’ll need to open an account and maintain a balance in order to qualify.

Credit unions typically have fewer fees than other lenders.

When you refinance your student loans with a credit union, you may be able to avoid some of the fees that other lenders charge. For example, many credit unions don’t charge origination fees or prepayment penalties.

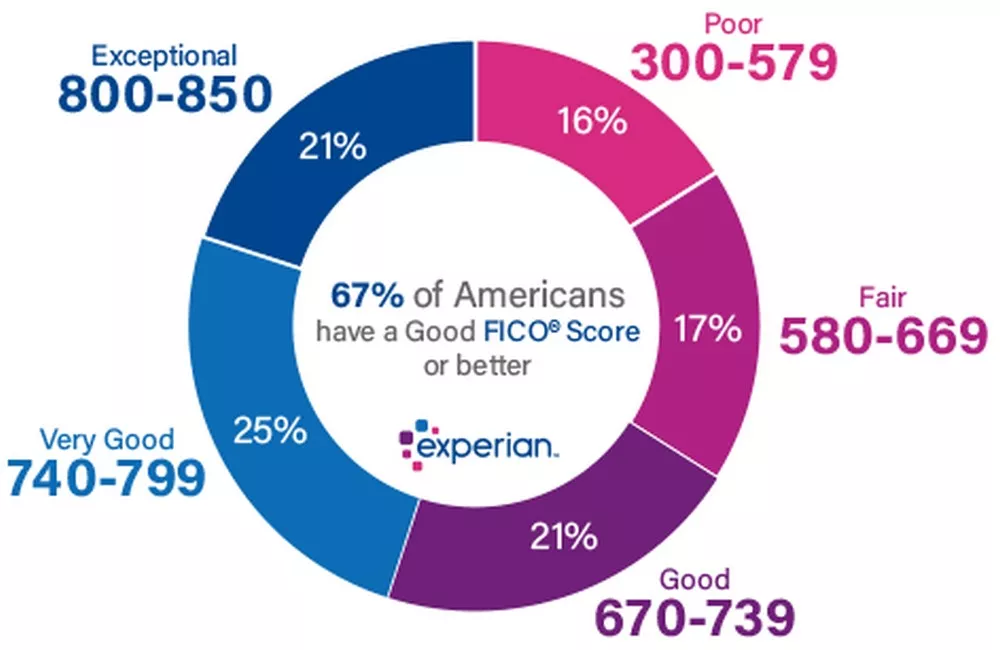

You may be able to get a lower interest rate if you have a good credit score.

If you have a good credit score, you may be able to qualify for a lower interest rate when you refinance your student loans with a credit union. This can help you save money over the life of your loan.

You may need to provide collateral to qualify for a loan.

Some credit unions may require you to provide collateral in order to qualify for a student loan. This means you may need to put up your home or another asset as security for the loan.

If you’re considering refinancing your student loans, a credit union may be a good option for you. Keep these things in mind before you make a decision.