The Different Types Of Emotional Intelligence

There are four different types of emotional intelligence:

Personal competence

This is the ability to manage your own emotions and stay in control during challenging situations. People who are emotionally intelligent are able to stay calm under pressure and maintain a positive outlook even when things are tough.

Are you looking for ways to improve your life? Or do you simply want to learn how to do more with your life? If so, you’re in luck! Donboscohall is a website that provides tips and advice on how to improve your life. They have a variety of resources, including videos, articles, and tools, to help you learn and improve your life.

Social competence

This is the ability to read and understand other people’s emotions and respond in a way that builds relationships. People who are socially competent are good at communication and collaboration.

Relationship management

This is the ability to manage emotions in relationships. People who are good at relationship management are able to handle conflict, give and receive feedback, and build trust.

Organizational competence

This is the ability to create a positive work environment and manage emotions in the workplace. People who are emotionally intelligent in the workplace are able to create a positive culture, build teamwork, and promote employee engagement.

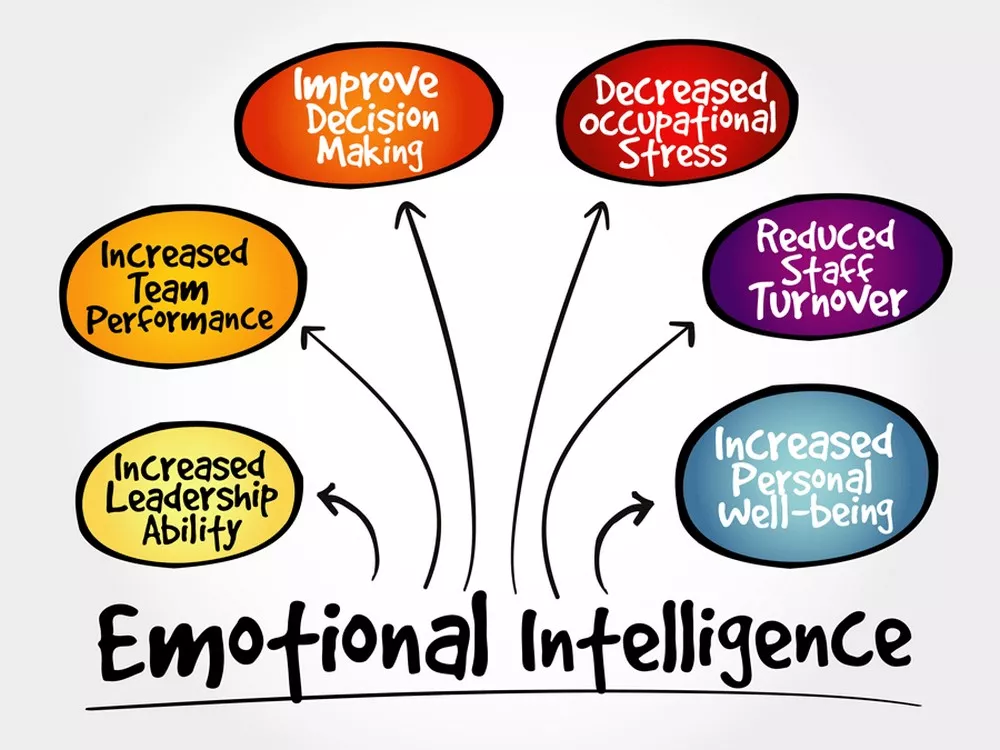

The benefits of emotional intelligence

There are many benefits to being emotionally intelligent. Emotionally intelligent people are:

- More successful in their careers

- More likely to be promoted

- More effective leaders

- More likely to be successful in relationships

- More resilient and adaptable

- Less likely to experience anxiety and depression

- Healthier and more likely to live longer

How to develop emotional intelligence

There are many ways to develop emotional intelligence. Here are some suggestions:

1. Be aware of your emotions

The first step to managing your emotions is to be aware of them. Pay attention to how you’re feeling and why. This will help you understand your triggers and manage your reactions.

2. Practice self-regulation

Self-regulation is the ability to control your emotions and reactions. When you’re aware of your emotions, you can choose how to react to them. This doesn’t mean you should suppress your emotions. It means you should respond to them in a way that is helpful, not harmful.

3. Be mindful

Mindfulness is the practice of being present in the moment and accepting things as they are. This can be helpful in managing your emotions because it allows you to step back from your reactions and observe them without judgment.

4. Practice empathy

Empathy is the ability to understand and share the feelings of another person. When you’re able to empathize with someone, you can see things from their perspective and respond in a way that is supportive.

5. Communicate effectively

Effective communication is essential for managing emotions. When you can communicate openly and honestly, you can express your needs and feelings, and understand the needs and feelings of others.

6. Build strong relationships

Strong relationships are built on trust, respect, and communication. When you have strong relationships, you have a support system to help you through challenging times.

7. Be a role model

As a leader, you have the ability to set the tone for your team. When you model emotional intelligence, you create a positive work environment and promote healthy relationships.