Looking to get the best auto refinance rate? Here are a few tips to help you get the best possible deal!

Kobe9 is a website that offers tips and advice on how to save money on your weekly budget. The website has a variety of articles and tools that can help you save money on your everyday expenses. The website also has a forum where you can ask questions and get advice from other users.

Make sure you are getting a rate that is good for your specific needs.

When it comes to refinance rates, it is important to get a rate that is good for your specific needs. To find out what you need to get the best refinance rate, you may want to do a search on Edmunds.com. There you will find a variety of rates for different vehicles and sizes.

Don’t be afraid to ask for help.

If you are feeling overwhelmed when it comes to finding a refinance rate, don’t be. You can always ask a friend or family member for help. They may be able to point you in the right direction.

Don’t be afraid to compare rates.

When you are looking to get a refinance rate, it is important to compare rates. This will help you get a sense of what is best for you. You may also want to use Edmunds.com’s car insurance comparison feature. This will help you see how much you are paying for different types of insurance and compare rates.

Be prepared for the application process.

When it comes to getting a refinance rate, be prepared for the application process. This may take a little bit of time, so be prepared to wait. You may also want to consider using a refinance calculator. This will help you see how much you will save on your refinance.

Don’t be afraid to ask for help.

If you are feeling overwhelmed when it comes to finding a refinance rate, don’t be. You can always ask a friend or family member for help. They may be able to point you in the right direction.

Welcome to Auto Refinance Rate, your one-stop shop for finding the best auto refinance rate for your needs. Our team of experts has gathered the latest information and recommendations to help you get the best auto refinance rate for your vehicle.

Auto Refinance Rate has assembled a wide variety of information to help you find the best refinance rate for your vehicle. We have a variety of reports and reviews from past customers to help you make your decision.

We also have a wide variety of resources to help you get started. We have a blog post about the best refinance rates for cars and trucks, a blog post about the best auto refinancing companies, a blog post about the best auto loans, and a blog post about the best car loans.

We hope you find our information helpful. Thank you for visiting Auto Refinance Rate.

When it comes to getting the best auto refinance rate, there are a few things to keep in mind. First, always compare rates with different lenders before making a decision. second, find a lender that is reputable and have a good credit history. Finally, always ask for a free quote before making a decision.

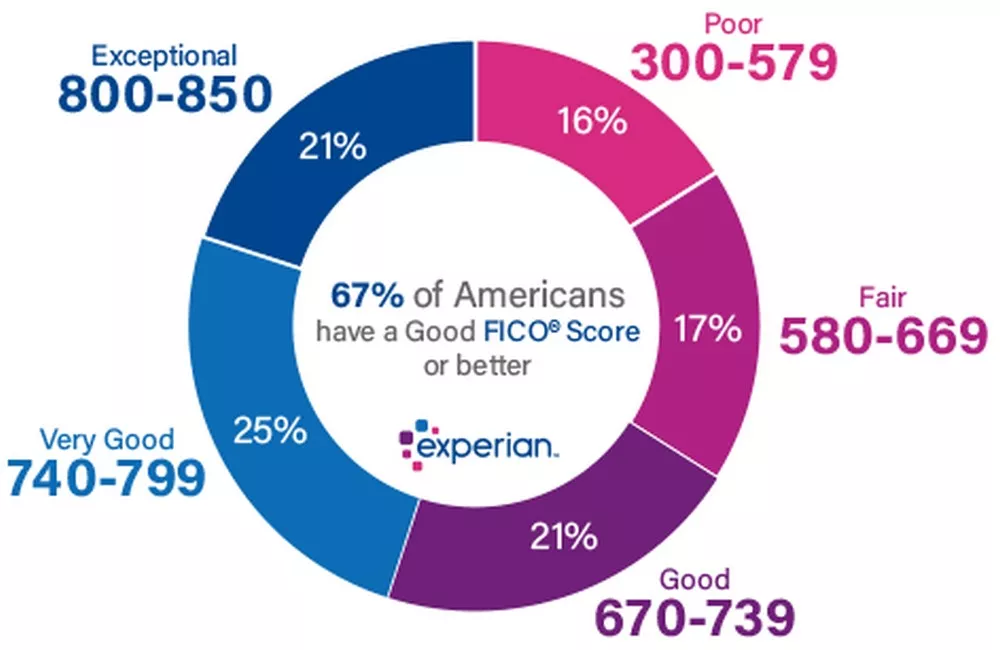

When looking for a refinance, it is important to keep in mind that the interest rates will vary depending on the type of refinance and the credit score of the car. Additionally, each lender has different terms and conditions that should be considered.

One of the most important factors to consider when looking for a refinance is the terms. For example, a standard refinance term is 6 to 12 months, but some lenders offer a longer term. The important thing is to find a refinance that is best for your needs and budget.

Another important factor to consider is the credit score of the car. Some lenders require a higher credit score for a refinance, while others will give you a lower interest rate if the credit score is good. It is important to find a lender that offers a good credit score before making a decision.

Finally, it is important to ask for a free quote before making a decision. Many lenders offer free quotes, so it is important to ask for one. This will help you to get a better refinance rate and avoid any surprises.

When you refinanced your car, you were likely quoted a certain rate based on the size of your car. But what if your car is smaller than what was quoted?

There are a few things you can do to increase your chances of getting a better rate. First, it’s important to remember that the interest rate quoted on a car refinancing is a percentage of the total amount of your loan. So if your car is worth $30,000 and the interest rate is 8%, the total cost of the loan will be $36,000.

Second, compare rates between different lenders.

Third, always read the terms and conditions of the car refinancing before you sign anything.

Finally, always talk to your car’s previous owner and/or the dealership about your refinancing. They may have a better idea of what you should expect.