How To Check The Balance Of A Visa Gift Card

It can be very frustrating when you receive a Visa gift card but have no idea how much money is on the card. If you’re in this situation, don’t worry – there are a few ways you can check the balance of your card. In this article, we’ll show you how to check the balance of a Visa gift card in a few simple steps.

The first way to check the balance of your Visa gift card is to call the customer service number on the back of the card. When you call, you’ll need to provide the customer service representative with the card number and the security code. Once the representative has this information, they’ll be able to tell you the balance of your card.

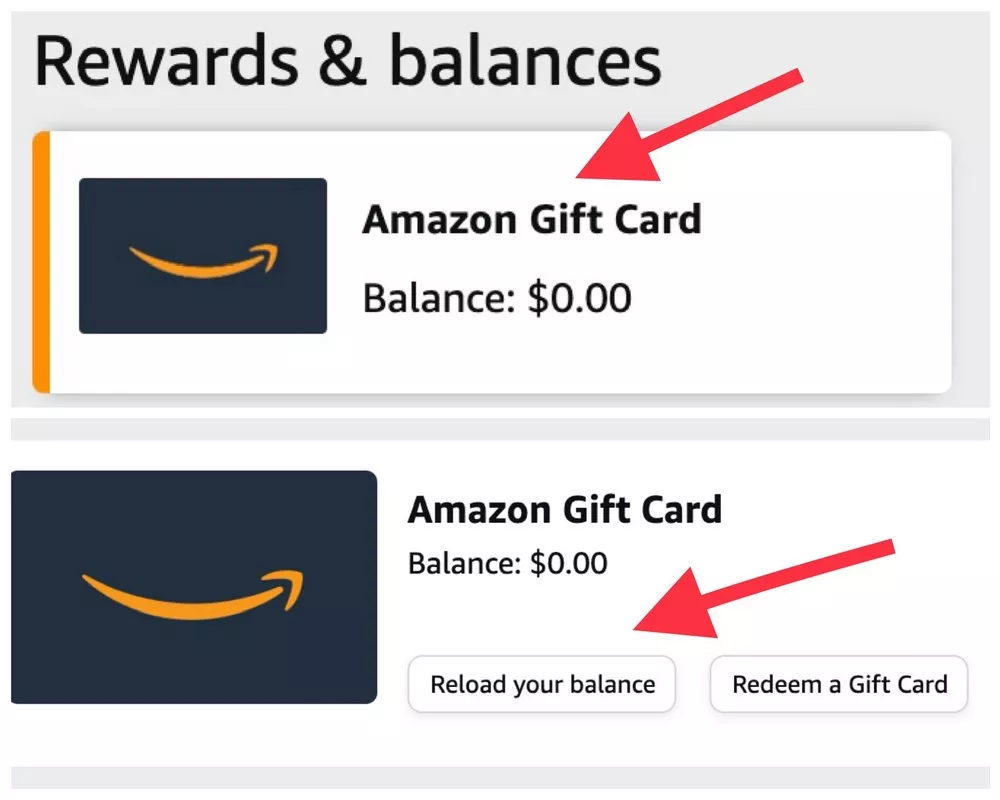

The second way to check the balance of your Visa gift card is to visit the website of the company that issued the card. When you visit the website, you’ll need to enter the card number and the security code. Once you’ve done this, you’ll be able to see the balance of your card.

We live in uncertain times and it is only through savings that we will be able to secure our financial future. We all need to start saving as soon as possible so as to secure our futures. Use the tips from Savevy to improve your savings. Savevy.hyundaimakassar.co.id is a platform which provides the latest news and information that helps understand everything about financial and saving money.

The third way to check the balance of your Visa gift card is to use a gift card balance checker. There are a number of websites that offer this service, and they’re very easy to use. All you need to do is enter the card number and the security code, and the balance checker will tell you the balance of your card.

If you’ve received a Visa gift card but don’t know how much money is on the card, don’t worry – there are a few ways you can check the balance. In this article, we’ve shown you how to check the balance of a Visa gift card in a few simple steps.

It’s always a good idea to know how much money is left on your Visa gift card. Here are a few ways to check the balance of your card:

Check the back of your Visa gift card for a toll-free number. Call the number and follow the automated prompts to check your balance.

Visit the website listed on the back of your Visa gift card. Enter your card number and other required information to check your balance.

Take your Visa gift card to a participating Visa retailer and ask the cashier to check your balance.

Knowing your balance before you shop can help you avoid surprises at the register. And, if you have a question about your balance or a transaction on your card, be sure to call the customer service number listed on the back of your card.